Analyse Energy Sales Strategy in a Portfolio with Storage to Ensure Maximum Revenue

This case study highlights the successful implementation of an automated revenue optimisation solution for a portfolio of five battery-hybrid PV assets in the UK. The solution calculates the daily level of battery charge, identifies optimal periods for charging and discharging based on prices in different markets, estimates energy discharge revenues, charging costs and the overall value captured by the battery. In addition, it compares the overall optimal value with the value obtained by following the market player's sales strategy, enabling informed decision making and improving the profitability of the portfolio.

CONTEXT

The client, an owner of a portfolio consisting of five battery-hybrid PV assets in the UK, was looking to optimise revenue through a more efficient battery charging and discharging strategy.

CHALLENGES

The client faced the following challenges:

- Complexity of Analysis: Manually analysing loading, unloading, price and market data was time-consuming and prone to errors.

- Lack of Visibility: The lack of an automated system made it difficult to enable a continuous view on the loading strategy developed by the market player, and its effect on revenue.

- Strategy Evaluation: Evaluating the marketer's sales strategy required time-consuming and often incomplete manual analysis.

SOLUTION

Quintas Analytics developed and implemented a comprehensive automated solution to address the above challenges:

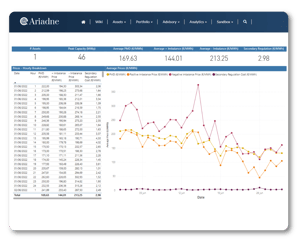

- Automated Daily Calculations: The system calculates the daily state of charge of the batteries, the optimal periods for charging and discharging, and estimates revenues and costs.

- Automated Comparisons: The optimal overall value of the battery is compared with the current value obtained by the market agent's sales strategy.

- Daily Reports and Notifications: The management team receives daily notifications and reports with results and comparisons.

RESULTS AND BENEFITS

Implementing the solution had a significant positive impact on profitability and decision making:

1. Informed Decision Making: Automated benchmarking enabled continuous evaluation of the marketer's loading and sales strategies.

2. Revenue Optimisation: The price-based charging and discharging strategy improved revenue capture and operational efficiency.

3. Time Saving: The automated process reduced the need for laborious manual analysis and late reconciliations.

4. Increased Visibility: The management team had constant sight of the effect of the charging and discharging strategy on revenues.

5. Improved Sales Strategy: Benchmarking allowed the asset manager to detect inefficiencies in the market player's strategy and help resolve them.

CONCLUSIONS

The solution enacted for revenue optimisation in a PV portfolio with storage in the UK proved a success story for improving profitability and informed decision making. Process automation, daily calculations and automatic benchmarking provided essential tools for effective management and a far more efficient sales strategy. This solution sets a valuable example for the management of similar projects in the field of solar energy and hybrid asset optimisation.