Evaluate the Performance of Panels to Manage Warranty Claims

This case study highlights the successful implementation of an automated solution that allowed the owner of a portfolio of 150 PV assets in different European markets to easily download and analyse string-level current data for the last two years. This automated solution compares current values with those guaranteed by the panel manufacturer, identifying performance issues that may lead to contractual warranty claims. The automated analysis allows the asset manager to efficiently define its warranty claim strategy, prioritising those assets that have the greatest impact on the overall performance of the portfolio.

CONTEXT

The owner of the portfolio, consisting of 150 PV assets with an average capacity of 10MW in different European markets, sought to optimise their management of contractual guarantees to improve the profitability and performance of their assets.

CHALLENGES

The owner faced the following challenges:

- Huge Volumes of Data: Manual downloading and analysis of current data for 150 assets over a two-year period was laborious and prone to errors.

- Contractual Guarantees: Identifying assets that did not comply with the manufacturer's warranty conditions required detailed analysis.

- Prioritisation of Claims: It was necessary to prioritise warranty claims in order to focus resources on those assets that had the greatest impact on the portfolio.

SOLUTION

Quintas Analytics developed a complete solution to address the above challenges:

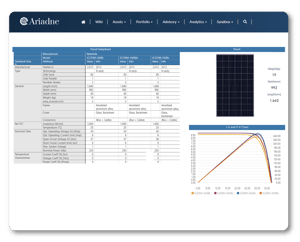

- Automated Data Download: The solution enabled the automatic and systematic download of string-level current data for the previous two years.

- Comparison with Guaranteed Values: An automated comparison of current values with those guaranteed by the panel manufacturer was carried out.

- Identification of Performance Issues: Assets that did not comply with contractual warranties were identified on the basis of current deviations.

- Prioritisation of Claims: Assets with larger deviations were prioritised for warranty claims.

RESULTS AND BENEFITS

Implementing the solution had a significant impact on warranty optimisation and portfolio profitability:

1. Efficient Analysis: The automated analysis allowed for easy identification of performance problems in the panels.

2. Intelligent Prioritisation: Claims were prioritised according to their overall impact on the portfolio.

3. Improved Profitability: The solution helped improve profitability by ensuring that assets meet specified values.

4. Saving Time and Resources: The need for manual analysis was reduced and resources were allocated more efficiently.

CONCLUSIONS

The solution implemented for the optimisation of warranty claims in a PV portfolio proved to be essential for improving the profitability and performance of the assets. Automation in data download and analysis enabled faster and more accurate identification of performance issues, which in turn allowed the asset manager to prioritise warranty claims effectively. This approach can serve as a model for collateral management in similar portfolios, improving operational efficiency and profitability.