Analyse the Historical Performance of Assets Before Acquiring Them to Detect Hidden Issues

This case study highlights the successful implementation of a solution to collect and analyse historical production and irradiance data from SCADA across a portfolio of three PV assets in the UK over the last five years. Analysis of data quality and identification of historical technical issues enabled the buyer to gain an accurate picture of the assets' real performance, detect hidden problems and plan for their resolution prior to acquisition, strengthening the buyer's position in the negotiation process and ensuring the assets' future profitability.

CONTEXT

The buyer was interested in acquiring a portfolio of three PV assets in the UK, with an average capacity of 15MW each. Prior to the acquisition, the buyer wanted to obtain a detailed understanding of the assets' historical performance in order to make an informed decision and mitigate potential hidden technical risks.

CHALLENGES

The buyer faced the following challenges:

- Complex Historical Data: Collecting and analysing five years of historical production and irradiation data across multiple assets is a difficult and complicated process.

- Data Quality: The quality of historical data could vary, which meant that it required rigorous assessment before proceeding with performance analysis.

- Identifying Hidden Issues: It was essential to identify historical technical problems that could affect the future profitability of the assets.

- Informed Negotiation: The buyer required an accurate picture of historical performance to strengthen their negotiating position.

SOLUTION

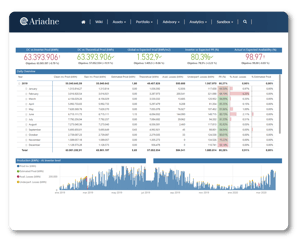

Quintas Analytics developed a complete solution to address the above challenges:

- Historical Data Collection: Historical production and irradiation data from the assets for the previous five years was collected and processed from SCADA.

- Data Quality and Analysis: A rigorous data quality analysis was carried out to identify possible deficiencies and discrepancies.

- Identification of Technical Issues: Historical technical issues affecting asset availability and performance were assessed.

- Detailed Reporting: A comprehensive audit was generated, providing an accurate overview of historical performance and detailing any issues identified throughout the analysis period.

RESULTS AND BENEFITS

Implementing the solution had a significant impact on profitability and decision making:

1. Informed Decision Making: The buyer was able to make an informed acquisition choice based on accurate historical data.

2. Minimising Risks: Early identification of technical problems made it possible to plan for their resolution prior to procurement.

3. Improved Negotiation: The buyer's trading position was strengthened, as it was underpinned by solid data.

4. Future Profitability: The resolution of historical technical problems ensured the future profitability of the assets from the moment of acquisition.

CONCLUSIONS

The solution implemented for the historical performance analysis of PV assets in the UK proved to be a critical factor in a successful and profitable acquisition. The collection, analysis and evaluation of historical data provided the buyer with an accurate understanding of the assets, detecting hidden issues and strengthening their negotiating position. This approach can serve as a model when acquiring similar assets, permitting more informed and confident decision making.